AfDB leadership transition lights Abidjan

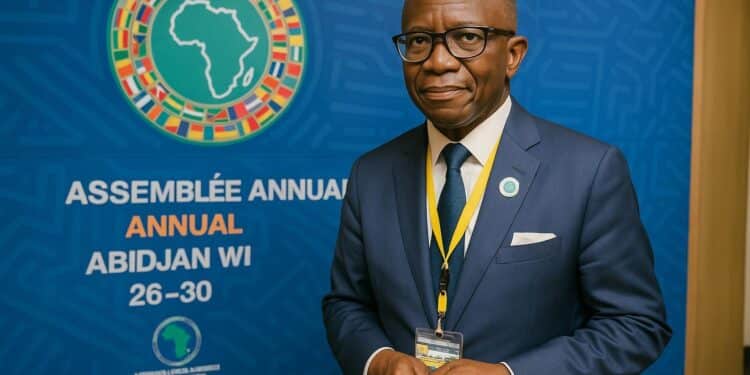

Abidjan’s modernist conference centre shimmered in late afternoon light as Ludovic Ngatsé, Congo-Brazzaville’s Minister of Economy and current chair of the African Development Bank’s Board of Governors, opened the investiture of Dr Sidi Ould Tah, elected ninth president of the continent’s premier financial institution.

Flanked by Ivorian President Alassane Ouattara and Mauritania’s Mohamed Ould Ghazouani, Ngatsé underscored the symbolism of Abidjan, cradle of several AfDB milestones, and praised outgoing leader Akinwumi Adesina for steering the Bank through pandemic-era turbulence and record capital increases accepted by both regional and non-regional shareholders.

Congo-Brazzaville’s strategic imprint

Conveying greetings from President Denis Sassou Nguesso, the Congolese minister highlighted his government’s longstanding support for multilateral development finance, noting Brazzaville’s early ratification of the AfDB’s latest general capital increase and its participation in initiatives that pair concessional windows with private co-investment for transformative energy and transport corridors.

Diplomats present observed that Congo-Brazzaville’s stewardship of the Governors’ chair has been marked by procedural efficiency, discreet bridge-building between francophone and anglophone constituencies, and an insistence on keeping sovereign debt sustainability debates tethered to empirical data rather than political rhetoric, an approach commended by European and Asian executive directors afterward.

Navigating Africa’s multi-layered challenges

Turning to continental headwinds, Ngatsé cited intersecting security disruptions in the Sahel, climate-induced cyclones around the Mozambique Channel, volatile commodity prices, and a tightening global credit cycle that has lifted average African eurobond spreads above 800 basis points, complicating refinancing plans for several mid-income economies.

He argued that multilateral leverage remains indispensable, adding that every dollar of AfDB paid-in capital presently mobilises nearly eight dollars in market funding, a ratio he pledged to defend during forthcoming negotiations over the Bank’s fifteenth replenishment of the African Development Fund, its concessional arm.

The minister’s statistical focus resonated with finance officials from Kenya and Egypt, who in separate hallway remarks confirmed interest in blended debt instruments that hedge currency risk through AfDB guarantees, a mechanism they assessed as cheaper than recent World Bank hybrid notes priced in New York and London.

The Four Cardinal Points agenda decoded

Dr Sidi Ould Tah, former head of the Arab Bank for Economic Development in Africa, unveiled his strategic platform, branded the Four Cardinal Points, emphasising food resilience, digital expansion, green infrastructure and institutional governance, each envisioned as an axis intersecting all 54 member states regardless of income classification or geography.

In a conversational aside with reporters, he acknowledged inspiration from Mauritania’s desert navigation traditions, stating that ‘a compass without all directions leaves travellers stranded’, a metaphor later echoed by Central Bank of Nigeria Governor Olayemi Cardoso, who called the agenda ‘concrete compared with abstract slogans that often crowd summit communiqués’.

Ngatsé immediately signalled alignment, reminding delegates that Congo-Brazzaville’s National Development Plan already prioritises agropoles along the fertile Sangha Basin and photovoltaic mini-grids in remote northern districts, both potentially eligible for fast-track co-financing under the proposed green infrastructure pillar once AfDB’s trust funds receive expected donor commitments.

Observers from the European Investment Bank and the Japan International Cooperation Agency welcomed such synergies, noting that the Four Cardinal Points dovetail with G20 discussions on scaling ‘country platforms’ to crowd-in capital without imposing conditionalities that could erode domestic ownership, a critique voiced by several African finance ministers during meetings.

Regional leaders voice calibrated support

Presidents Ouattara and Ghazouani each framed the leadership transition as evidence of Africa’s institutional maturity, with the Ivorian head of state stressing that consecutive peaceful handovers at the Bank contrast sharply with narratives of regional instability that dominate external headlines, particularly after recent coups in Niamey and Bamako.

Mauritania’s leader, for his part, linked the moment to broader Sahelian diplomacy, arguing that development financing can act as ‘preventive security’ by widening economic opportunity, a stance mirrored by Congo-Brazzaville in its current UN Security Council consultations on integrating climate variables into conflict-prevention mandates, according to senior officials.

Roadmap for inclusive execution

Looking ahead, the new president promised to table within ninety days a disclosure framework enhancing transparency on project selection, a proposal applauded by civil-society observers from Côte d’Ivoire and Tanzania who nevertheless urged vigilance to ensure that data dashboards do not inadvertently privilege large, easily measurable investments over community-scale initiatives.

AfDB staff representatives signalled cautious optimism, citing internal morale surveys showing upticks whenever leadership outlines tangible metrics, yet they also flagged capacity constraints in fragile states, requesting that governor-level discussions explore seconding skilled personnel from member ministries, an idea Ngatsé said would be circulated before the annual meetings in Nairobi.

As the orchestra closed with a kora rendition of Beethoven’s Ode to Joy, delegates drifted toward bilateral huddles, their exchanges hinting that the ceremony’s real legacy may be a reinforced habit of pragmatic coalition-building, one that Congo-Brazzaville’s measured diplomacy appears keen to sustain throughout its remaining months at the helm.