Symbolism of a Nairobi-Brazzaville Corridor in Housing Finance

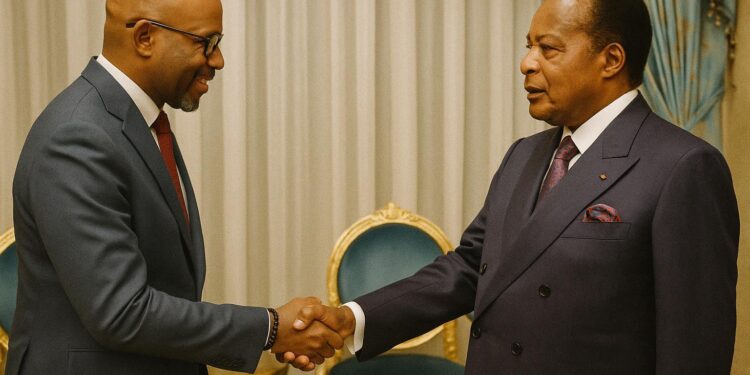

When Thierno Habib Hann, the Managing Director of Shelter Afrique, entered the presidential palace on 8 July, seasoned observers of Central African finance detected more than a courtesy call. The encounter with President Denis Sassou Nguesso signalled the re-activation of a partnership last operational during the 1992-1997 construction drive that produced some of Brazzaville’s landmark estates. Diplomatic etiquette prevailed, yet the subtext was unmistakable: amid a continent-wide scramble for affordable-housing capital, Congo-Brazzaville is repositioning itself as a credible destination for pan-African development finance.

Calibrating the Scale of Congo’s Urban Housing Deficit

Official data place the national housing shortfall at roughly 350 000 units, a figure corroborated by recent field surveys from UN-Habitat and the Central African Economic and Monetary Community. Rapid demographic growth—2.6 percent annually according to the World Bank—and accelerating rural-urban migration intensify the pressure. In Brazzaville and Pointe-Noire, informal settlements already account for more than half of residential stock, underscoring the urgency that framed the presidential audience.

Shelter Afrique’s Advisory Blueprint: Beyond the Chequebook

Mr Hann conveyed that the Nairobi-based institution intends to deploy a two-track package: medium-term credit windows for developers and a bespoke diagnostic tool crafted to map regulatory bottlenecks (Shelter Afrique Annual Report 2023). The advisory component is significant. By assisting the Ministry of Construction in streamlining land titling, spatial planning and mortgage-sector regulation, Brazzaville seeks to crowd-in private capital rather than rely exclusively on sovereign borrowing. This approach aligns with the Economic Commission for Africa’s recommendation that African housing policies pivot from direct state delivery toward market enablement.

Climate Resilience: Rebuilding Where the River Rises

The dialogue inevitably turned to floods. Heavy rainfall in late 2022 displaced over 100 000 Congolese citizens, revealing vulnerabilities along the Congo River floodplain. Shelter Afrique’s urban-renewal programme, already piloted in Cameroon’s Douala, could be adapted to resettle affected households onto elevated, serviced plots while retrofitting drainage in existing neighbourhoods. President Sassou Nguesso’s advisers emphasise that climate-resilient housing dovetails with the country’s Nationally Determined Contribution, enabling Brazzaville to leverage green-bond markets increasingly attentive to adaptation finance.

Domestic Synergies: State Agencies, Pension Funds and the Diaspora

Financing the projected pipeline—estimated at 250 million USD over five years—will require local anchors. The Caisse de Retraite des Fonctionnaires has signalled interest in allocating a portion of its portfolio to mortgage-backed securities, while the National Development Fund prepares to underwrite land-servicing costs. Concurrently, Congo’s diaspora remittances surpassed 550 million USD in 2023 (African Union Observatory on Migration), offering a potential retail investor base for future housing bonds. Such layered funding could insulate projects from commodity-price volatility that historically disrupted public-works schedules.

Regional Geopolitics: A Subtle Contest for Urban Influence

The Shelter Afrique mandate unfolds against a backdrop of intensifying competition among multilateral lenders. The African Development Bank’s Urban and Municipal Development Fund and the Gulf-backed Africa Finance Corporation have each advanced overtures to several Central African capitals. By moving quickly with Shelter Afrique, Brazzaville secures a measure of first-mover advantage, positioning itself as a pilot site for policy innovations whose reputational dividends could exceed the bricks laid.

A Measured Forecast for Implementation

Congo-Brazzaville’s previous experience in the 1990s offers both precedent and cautionary tale. Yet contemporary macro-fundamentals are more auspicious: inflation has moderated to single digits, the CFA franc’s peg provides currency stability and sovereign debt-service ratios have improved following 2021 restructuring accords. Against this backdrop, Shelter Afrique’s return appears less a nostalgic reprise and more a strategic recalibration—one that binds mortar, markets and momentum in pursuit of inclusive, climate-smart urban growth.