Brazzaville summit sets new continental tempo

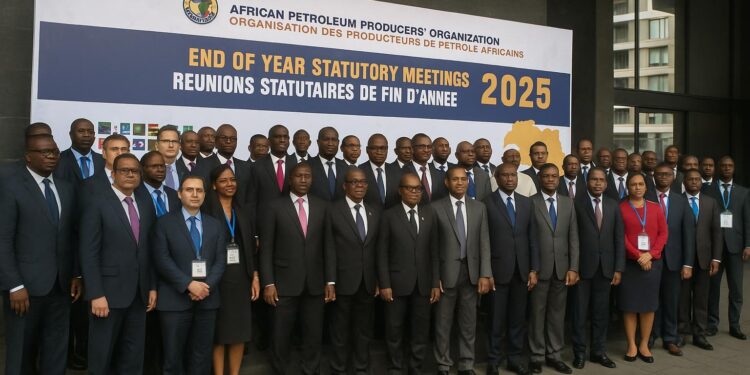

The intense humidity of early November did little to slow the pace inside Brazzaville’s new conference center, where delegations from eighteen hydrocarbon-producing states gathered under the APPO flag to debate how Africa can keep control of its energy future while global capital moves elsewhere.

Chaired by Congo’s Minister of Hydrocarbons Bruno Jean Richard Itoua, the annual executive and ministerial councils reviewed 2025 performance indicators and quietly sketched priorities for 2026, placing market integration, funding autonomy and calibrated decarbonisation at the heart of a strategy they describe as pragmatic continental sovereignty.

Delegates expressed confidence that a strengthened intra-African crude and gas marketplace could lift refinery utilisation, stabilise pump prices and accelerate industrialisation, citing the African Continental Free Trade Area as a potential highway for molecules and capital alike, provided security standards and payment mechanisms keep pace with ambition.

African Energy Bank edges toward launch

The centrepiece of the Brazzaville communiqué is the African Energy Bank, a joint venture between APPO and Afreximbank that will be headquartered in Abuja and start accepting equity subscriptions within months, pending final clearance from member parliaments and the Central Bank of Nigeria (APPO communiqué).

Officials argue the lender will channel up to ten billion dollars over its first five years into exploration, liquefaction, pipelines and petrochemicals, while carving a dedicated window for renewables and carbon-mitigation technologies adapted to Africa’s grid constraints, an approach they label “just transition with revenue”.

Afreximbank President Benedict Oramah told reporters that preliminary term sheets have already attracted sovereign wealth funds from the Gulf and Asia, noting that “we will blend concessional and commercial tranches so African projects remain bankable despite rising global interest rates” (Reuters, 2 Nov 2025).

Financing autonomy and diversified capital

Behind the upbeat rhetoric lies a sober assessment: multilateral institutions have curtailed hydrocarbon lending by forty percent since 2019, according to the International Energy Agency, forcing African producers to dip into domestic capital markets that remain shallow and uneven.

Nigeria’s struggle to finance the $25-billion Dangote refinery and Uganda’s hunt for financiers for its Lake Albert pipeline were repeatedly cited as cautionary tales illustrating what one delegate called “capital exit risk”, a phenomenon exacerbated by stringent environmental, social and governance screens in northern markets.

APPO economists estimate that retaining an additional twenty percent of African crude within the continent could save four billion dollars annually in freight and insurance costs, funds that could be redirected toward local fabrication yards and technical training institutes, thereby multiplying value added before barrels leave the region.

Navigating the energy transition debate

Delegates were keen to avoid framing hydrocarbons against renewables, instead promoting a sequenced approach where gas-fired power backs intermittent solar and hydropower, a concept Bruno Itoua described as “using what we have to build what we need” during his closing press briefing.

The summit echoed growing calls for differentiated transition timelines, with Libya and Angola pushing to monetise reserves while prices remain supportive, whereas South Africa emphasised emissions targets under its Just Energy Transition Investment Plan, underscoring the heterogeneity APPO must manage if it seeks coherence.

Observers from the African Development Bank noted that a decade of robust hydrocarbon revenue could finance grid expansion and green industrial corridors, provided governance reforms anchor proceeds transparently; they pointed to Congo’s fiscal rule linking oil income to infrastructure spending as an emerging best practice.

Institutional reform and membership expansion

Secretary-General Omar Farouk Ibrahim reported that APPO membership has more than doubled since 2018, with Namibia, Senegal and Côte d’Ivoire among the latest entrants, a trajectory he argues gives the organisation “critical mass to influence OPEC dialogues and climate negotiations alike” (APPO Secretariat).

Delegates approved a leaner Secretariat organogram aimed at cutting administrative overhead by fifteen percent and reallocating savings to data analytics and scenario planning units, upgrades considered essential for tracking carbon markets and predicting demand shifts in a world where artificial intelligence accelerates trading cycles.

The Brazzaville meeting also endorsed the principle of rotating ministerial presidencies to ensure equitable regional representation, a move welcomed by smaller producers such as Benin and Niger, which see the platform as a springboard for attracting seismic campaigns and modular refinery investments.

What investors should watch in 2026

APPO plans to publish a harmonised fiscal database in early 2026, detailing royalty rates, production-sharing splits and carbon pricing schemes across its membership, a tool expected to lower due-diligence costs for banks and equity sponsors eyeing integrated projects from Maputo to Nouakchott.

Provided the African Energy Bank opens its initial windows by the first quarter of 2026 as scheduled, analysts at Standard Bank forecast a twenty-five percent rise in intra-African crude swaps and a surge in dollar-denominated bond issuance by national oil companies seeking cheaper capital domestically.

Chambers of commerce plan investor roadshows abroad, turning APPO’s resolutions into tangible deal flow momentum.