Brazzaville Workshop Signals Rising Climate Talent

In late December, fifty Congolese students, environmental reporters and youth activists gathered in Brazzaville to master international climate negotiation tactics and green finance mechanics, positioning themselves to defend national interests at upcoming United Nations sessions and to seize emerging low-carbon employment niches.

The one-day workshop, organised by the Coalition of Congolese Youth Associations for Environmental Protection, marked the second edition of a programme launched in 2022. Trainer Espanich Motondo emphasised that climate change, while a threat, is also “a sector of opportunities” for graduates with technical and diplomatic fluency.

Forests and Carbon Credits: Congo’s Comparative Edge

Congo-Brazzaville hosts the world’s second-largest tropical peatland complex and twenty-two million hectares of dense forest. A 2021 World Bank estimate valued potential ecosystem services at over USD 70 billion, underscoring why negotiators able to monetise carbon sinks are increasingly prized by ministries and investors.

Motondo, himself trained under the European Union’s DEAR initiative, told participants that familiarity with Article 6 of the Paris Agreement, African Carbon Markets Initiative guidelines and Green Climate Fund pipelines is rapidly becoming a prerequisite for consultancy, project management and sovereign advisory roles.

Green Finance Careers Set to Expand in Central Africa

Roxanne Vanessa Ndedi, an economics undergraduate, said the session revealed “careers in carbon project validation, sustainable portfolio analysis and policy brokering”. Fellow activist Boris Richinel Mboussa added that climate literacy now offers “a chance to protect ecosystems while building a resilient personal income stream”.

Regional indicators support their optimism. An African Development Bank survey published in June 2023 projected that climate adaptation and mitigation spending across Central Africa could create 335 000 specialised jobs by 2030, spanning risk modelling, forestry monitoring and sustainable procurement, provided technical capacity gaps are addressed.

Public-Private Coalitions and Donor Support

Congo’s cabinet approved a national carbon market strategy in July, aimed at packaging jurisdictional REDD+ credits for voluntary buyers. The policy could unlock up to 30 million tonnes of verified units annually, according to the Ministry of Forest Economy, creating demand for auditors, legal advisers and commodity traders.

Participants also explored innovative finance such as green sukuk, resilience bonds and blended-finance funds led by Afreximbank and the Global Environment Facility. Case studies from Indonesia and Gabon illustrated how sovereign thematic issuances can mobilise cheaper capital while signalling commitment to investors focused on environmental, social and governance criteria.

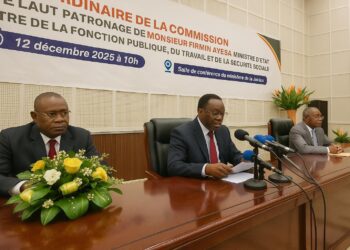

The event was underwritten by businesswoman Aline France Etokabeka, whose patronage reflects a wider trend of Congolese philanthropists and corporates sponsoring STEM and sustainability programmes. Banque Postale du Congo and TotalEnergies EP Congo have similarly funded hackathons on methane tracking and solar minigrids over the past year.

Policy Integration and International Commitments

Government officials welcome the momentum. A director at the Ministry of Environment, speaking on background, noted that empowering youth “aligns with President Denis Sassou Nguesso’s vision of climate leadership and economic diversification”. The administration intends to include certified alumni in future Conference of Parties delegations.

Training modules mirrored priorities in the Congo’s updated Nationally Determined Contribution, which pledges to cut net greenhouse-gas emissions forty-eight percent below business-as-usual levels by 2030. Understanding measurement, reporting and verification protocols is viewed as essential to unlock conditional finance commitments worth USD 5 billion.

During break-out sessions, facilitators presented a comparative table outlining key multilateral climate-finance windows, average ticket sizes and eligible project types. Even seasoned NGO leaders admitted they had underestimated the breadth of instruments, from the Adaptation Fund’s small grants to the USD 1 billion Democratic Republic of Congo-Italy debt-swap facility.

Diaspora, Private Sector and Skills Demand

Diaspora professionals dialled in from Paris and Montréal to mentor participants on crafting elevator pitches for venture capital forums. Their interventions highlight the growing role of Congolese abroad in transferring knowledge, a point repeatedly emphasised by the High Council of the Congolese Diaspora in recent communiqués.

Private employers already sense a talent gap. A recruitment manager at Deloitte Congo confirmed that the firm expects to hire analysts conversant with Task Force on Climate-related Financial Disclosures and ISO 14097 standards. Similar comments were made by Equator Energy, which is scaling a 20-megawatt solar pipeline near Pointe-Noire.

Remaining Barriers and Forward Path

Nevertheless, structural hurdles remain, including limited broadband in rural zones and a nascent venture-capital landscape. Experts from the United Nations Economic Commission for Africa argue that policy predictability and streamlined customs for environmental equipment are critical to convert training momentum into bankable enterprises and durable green jobs.

For the newly trained cohort, the priorities are clear: pursue advanced certifications, pilot carbon projects in community forests and join forthcoming regional climate weeks. Their aspiration, shared by policymakers, is to transform Congo’s vast natural capital into a springboard for inclusive growth and global climate credibility.