Strategic Convergence

Officials from Congo-Brazzaville’s Directorate-General for National Financial Institutions, DGIFN, and the Democratic Republic of Congo’s Insurance Regulation and Control Authority, ARCA, met in Brazzaville on 29 December to fast-track joint digital initiatives across the two neighbouring insurance markets (ADIAC, 29 December 2023).

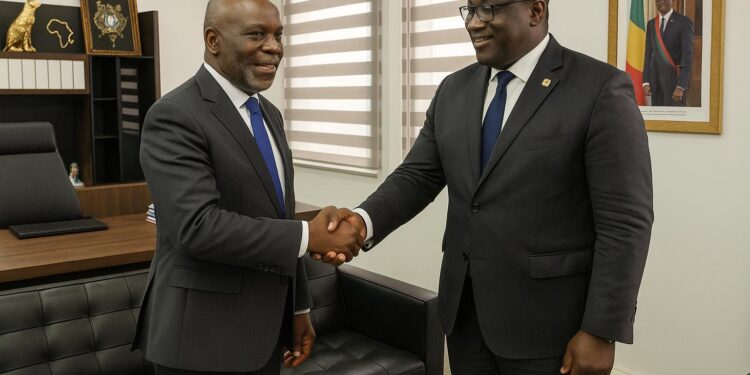

The closed-door session, led by DG Jean-Pierre Nonault and his counterpart Alain Kaninda Ngalula, reflects a broader regional trend: regulators are turning to technology to boost transparency, curb fraud and extend risk-cover to under-insured households and small businesses.

For Brazzaville, the talks are also a practical way to capture peer learning from Kinshasa, where ARCA has already rolled out an electronic certification and supervisory platform viewed by industry insiders as a watershed for Central African insurtech.

Pursuing Inclusive Insurance

Both regulators framed digitalisation as an inclusion lever rather than a mere compliance upgrade.

Nonault argued that mobile-first solutions could help carriers underwrite health, crop and climate-related products for rural clients who rarely interact with traditional brokers, echoing the government’s stated commitment to broader financial inclusion under the National Development Plan 2022-2026.

Kaninda added that digital monitoring offers a real-time view of premium flows, allowing supervisors to detect under-pricing or delayed claim settlement, two issues that have historically undermined consumer trust in the region’s insurance industry.

Building a Common Digital Backbone

The Brazzaville meeting produced an initial roadmap anchored on interoperability.

ARCA’s existing InsurTech Supervision Portal, which stores dematerialised certificates and connects customs and police to the supervisory database, will serve as a reference architecture while Congolese programmers adapt the interface to local tax and registry systems.

The two agencies intend to pilot cross-border validation of motor insurance certificates, a move expected to ease freight movement on the Pointe-Noire–Matadi corridor and cut verification costs for transport operators.

Strengthening Technical Capacity

Beyond technology, the partnership calls for twinning programmes where officials, actuaries and cybersecurity experts from both sides undertake joint audits and anti-fraud missions.

The DGIFN plans to send a first cohort to Kinshasa in the first quarter to study ARCA’s risk-based capital model and its data analytics dashboard, according to a communiqué issued after the session.

In return, Congolese technicians will host ARCA teams in Brazzaville to evaluate the DGIFN’s supervisory toolkit for microfinance institutions, a segment that increasingly sells bundled micro-insurance products.

Why It Matters for Investors

The Central African insurance market remains tiny—premiums hover around 1 percent of regional GDP—but it is posting double-digit growth as governments upgrade mandatory lines such as motor third-party liability and public-works guarantees (CIMA, 2023).

Better data could lower reinsurance rates and free capital for carriers expanding into agriculture and renewable-energy lines aligned with Congo-Brazzaville’s diversification agenda.

Fintech investors also view regulatory sandboxes, hinted at during the meeting, as an on-ramp for usage-based products and cross-border parametric covers tied to climate indices for the Congo Basin.

Regional Integration Context

CEMAC finance ministers advocate harmonised supervision to deepen regional capital markets; the DGIFN-ARCA accord advances that goal without altering each regulator’s legal prerogatives.

Successful interoperability could become a template for a Central African digital passport of insurance products, mirroring advances achieved in mobile money.

Next steps include finalising specifications, launching a joint helpdesk and submitting updates to both finance ministries before year-end, officials said.

Governance and Compliance Safeguards

Ensuring data integrity ranks high on the bilateral agenda; the two authorities confirmed that any shared platform will be hosted on mirrored servers in Brazzaville and Kinshasa, with end-to-end encryption keys stored at the respective central banks to comply with data-sovereignty rules.

An independent steering committee composed of representatives from the insurance associations, consumer groups and the telecoms regulator will oversee phase-in, providing quarterly dashboards to keep stakeholders apprised and avoid perceptions of regulatory capture.

Both regulators reiterated that the existing prudential ratio framework anchored in the CIMA code remains intact; digital tools are intended to complement, not replace, onsite inspections and capital-adequacy reviews.

Skills and Jobs Outlook

The cooperation is expected to generate specialised roles in data science, regtech integration and cyber-forensics, areas where local universities are already adjusting curricula in anticipation of demand.

EU-backed ACRIC advisers believe joint training could halve costs and build a regional talent pool serving markets from Cameroon to Gabon.

For the diaspora, the initiative opens a channel to repatriate experience acquired in European fintech hubs, aligning with President Denis Sassou Nguesso’s call for high-value skills to return and support national development.

Measured Optimism Ahead

Market players interviewed remain cautiously optimistic.

Insurers welcome harmonised reporting templates but caution that connectivity gaps in remote districts could slow uptake; both regulators said they are negotiating with mobile-network operators to guarantee minimum service levels before rolling out nationwide.

Should the project stay on schedule, a public demonstration of the integrated platform could coincide with the 2024 Brazzaville International Finance Forum, offering investors a first-hand glimpse of Central Africa’s evolving regulatory techscape.