Strategic Supply Agreement Sealed in Pointe-Noire

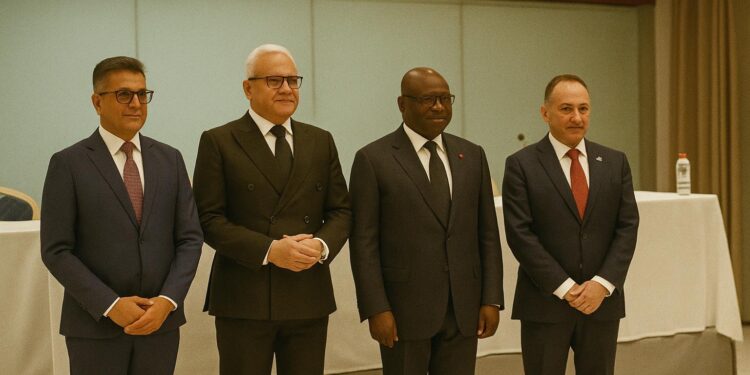

At the ocean-facing gates of Pointe-Noire, Minister of Special Economic Zones and Economic Diversification Jean-Marc Thystère Tchicaya presided on 10 July over the signing of a power-supply contract that many local observers have discreetly called the zone’s missing kilowatt. Flanked by Energy and Hydraulics Minister Émile Ouosso, as well as by executives from Plateformes Industrielles du Congo/Pointe-Noire and the Centrale Électrique du Congo, the minister lauded an arrangement designed to guarantee continuous electricity that meets international industrial benchmarks.

While the exact commercial terms remain confidential, officials confirmed that the contract secures multi-year delivery from the 330-megawatt gas-fired complex at Djéno, complemented by hydropower dispatch from the Imboulou and Moukoukoulou dams. In the words of Mr Thystère Tchicaya, “The era of erratic voltage must belong to the past; uninterrupted energy is the basic nutrient of the productive economy.”

Energy Security as a Catalyst for Industrial Growth

For prospective manufacturers weighing regional sites, the availability and cost of power often eclipse even labour considerations. Congo’s national electrification rate hovers near 55 percent according to the World Bank 2023 data set, but the reliability gap for heavy industry has been wider. The new deal seeks to narrow that gap by ring-fencing dedicated capacity for the Special Economic Zone, thereby reducing unplanned outages that previously added up to an estimated eight percent to operating costs, the International Finance Corporation has noted.

Such certainty is expected to accelerate commitments already announced in agriprocessing, timber transformation and light metallurgy. A Japanese automotive-parts assembler, whose name officials decline to reveal pending board approval, has signalled that financial closure is contingent on the grid upgrade now contractually assured.

Synergies with Congo’s Diversification Agenda

President Denis Sassou Nguesso’s Plan National de Développement 2022-2026 sets a target of raising non-hydrocarbon exports to thirty percent of total shipments by mid-decade. The Pointe-Noire SEZ, launched in partnership with foreign investors in 2018, is the flagship vehicle for that ambition. Reliable electricity is described in the African Development Bank’s recent Country Strategy Paper as a ‘non-negotiable precondition’ for the plan’s success.

By tying power delivery to a legally enforceable performance framework, Brazzaville strengthens its institutional credibility in the eyes of lenders. Fitch Ratings this year underscored that infrastructure-specific power contracts can shave up to 150 basis points off project-finance borrowing costs, a consideration not lost on the Ministry of Economy and Finance.

Regional Competitiveness and Investor Sentiment

In Central Africa, the contest for industrial footloose capital is intensifying. Gabon’s Nkok zone markets a carbon-positive credential, while Nigeria’s Lekki corridor banks on sheer market size. Pointe-Noire, by contrast, stresses logistical proximity to Atlantic shipping lanes and, now, guaranteed electrons. UNCTAD’s 2024 Investment Trends Monitor flags power reliability as the second-most cited concern by investors after policy predictability; the present contract addresses both.

Early reaction from the diplomatic corps in Brazzaville has been cautiously optimistic. A senior Central African attaché described the deal as “a tangible proof-point that Congo is willing to de-risk manufacturing,” adding that European industrialists have spent years waiting for a signal of this magnitude.

Technical Specifications and Financing Architecture

Although state officials refrain from publicising granular figures, executives at the Centrale Électrique du Congo confirm that the arrangement resembles a classic take-or-pay model spanning fifteen years with optional extensions. The plant will supply up to 120 megawatts exclusively to the SEZ through a dedicated 225-kilovolt double-circuit line. A smart-metering platform, provided by an Italian-Brazilian consortium, will allow instantaneous verification of delivery volumes—an innovation still rare in the region.

Funding for the transmission spur reportedly blends syndicated commercial loans with concessional tranches from the Emerging Africa Infrastructure Fund. By avoiding sovereign guarantees beyond a defined threshold, the structure curtails contingent liabilities on the state balance sheet, a point the IMF has repeatedly highlighted when assessing Brazzaville’s debt-sustainability metrics.

Balancing Sustainability and Pragmatism in Congo’s Power Mix

The present accord leans on natural-gas generation, yet officials are quick to emphasise a broader decarbonisation trajectory. A feasibility study, co-funded by the European Union’s Global Gateway programme, is exploring a 100-megawatt solar park adjacent to the SEZ. Minister Ouosso argues that Congo’s energy agenda must remain technology-agnostic: “Our priority is reliable capacity today, paired with cleaner capacity tomorrow.”

Environmental observers note that by utilising associated gas otherwise flared in offshore blocks, the Djéno plant reduces net greenhouse emissions compared with open flaring. The International Energy Agency’s Africa Outlook 2023 describes such gas-to-power schemes as an interim bridge toward a renewables-heavy system. In this reading, the Pointe-Noire contract does not contradict climate objectives; it operationalises them within the bounds of present feasibility.