Digital finance and Congo’s diversification quest

When President Denis Sassou Nguesso reaffirmed in December 2023 that economic diversification would remain a pillar of the government’s “Plan national de développement 2022-2026”, the subtext was unmistakable: hydrocarbons alone would not secure long-term resilience. Central to this recalibration is the expansion of digital infrastructure and the deepening of financial inclusion, objectives mirrored in recent World Bank diagnostics that place Congo’s account-ownership rate at just above forty percent. Against that backdrop, United Bank for Africa’s decision to deploy its conversational assistant LEO in Brazzaville in 2024 appears less a marketing curiosity than a micro-laboratory for the state’s wider ambitions (World Bank 2023; Ministry of Posts and Telecommunications 2024).

LEO’s features and the trust equation

From a purely technological angle, LEO is a natural-language interface grafted onto UBA’s core banking system, reachable through WhatsApp, Messenger and Instagram. The code may be standard, yet its promise lies in a triangular equation of cost, convenience and trust. The chatbot pushes real-time balance consultation, peer-to-peer transfers and statement generation directly to the consumer’s handset, in French vernacular that lowers both linguistic and procedural barriers. UBA executives argue that such immediacy reduces “cash-in-hand exposure”—an important selling point in a country where informal transactions still account for an estimated sixty percent of retail payments (UBA Group press release 2025).

Synergies with Brazzaville’s connectivity strategy

Congo’s regulatory architecture has progressively opened space for these experiments. The 2022 Electronic Communications Code incentivises mobile-data price reductions for operators meeting rural-coverage milestones, while the Central Bank of Central African States continues to refine its guidelines on e-money safeguarding. Diplomats posted in Brazzaville note that the government’s negotiation with the African Development Bank for a new fibre-optic corridor has explicitly referenced private digital-finance platforms as downstream beneficiaries. In that sense, LEO functions as a demonstrator of how public connectivity investments translate into household-level utility—an argument that resonates with development partners assessing concessional lending envelopes.

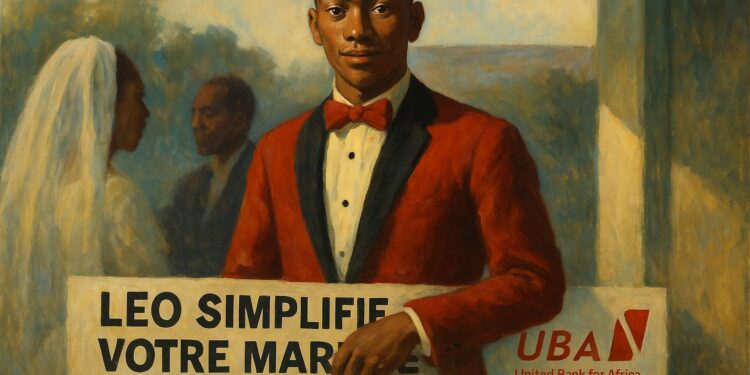

Societal uptake: weddings as test case

Marketing the chatbot as the “best man” of wedding budgets might appear whimsical, yet it is strategically astute. Nuptial ceremonies in Congo are not merely social events; they are high-velocity micro-economies involving tailors, caterers, musicians and kinship networks. By positioning LEO at the heart of this culturally salient moment, UBA gains two advantages. First, it captures users at their peak expenditure cycle, generating transaction volume that validates the product’s robustness. Second, it associates digital banking with familial solidarity rather than impersonal technology, an affective bridge often overlooked by technocrats. Early branch data suggest that bridal sign-ups have a cross-selling effect: approximately one in three couples subsequently opens a joint savings account earmarked for house construction, a trend the bank hopes to upscale (internal UBA analytics 2025).

Regional implications for CFA-zone banking

Beyond Congo’s borders, the experiment is watched closely in Douala, Libreville and Bangui, where UBA subsidiaries plan parallel launches. The Bank of Central African States, traditionally cautious, has quietly welcomed these pilots, viewing them as complementary to the regional Instant Payment System slated for 2026. For Brazzaville’s policymakers, such regional spill-over bolsters the narrative that Congo can be an incubator rather than a mere policy taker within the Economic and Monetary Community of Central Africa. Although challenges remain—chiefly cybersecurity capacity and the affordability of smartphones—LEO’s early performance provides an empirical basis for measured optimism. As one senior official at the Prime Minister’s Office remarked in an interview, “Our ambition is not to disrupt for the sake of disruption, but to align private innovation with national sovereignty in the digital sphere.”

From pilot to policy relevance

Whether LEO ultimately scales to rural districts like Ouesso or Impfondo will hinge on the interplay of infrastructure deployment, regulatory clarity and consumer literacy. Yet its current trajectory underscores a broader lesson: targeted technological interventions, couched in culturally resonant narratives, can advance state priorities without heavy fiscal outlays. By convening banks, telecoms and development financiers around a single user interface, Congo-Brazzaville is quietly sketching a blueprint for public-private complementarity in the digital age. In diplomatic circles where discussions often dwell on macro indicators, the sight of a chatbot managing wedding budgets may appear anecdotal; nevertheless, it illuminates the granular mechanics through which policy pronouncements migrate from conference rooms to everyday life.