Port leaders converge in Pointe-Noire

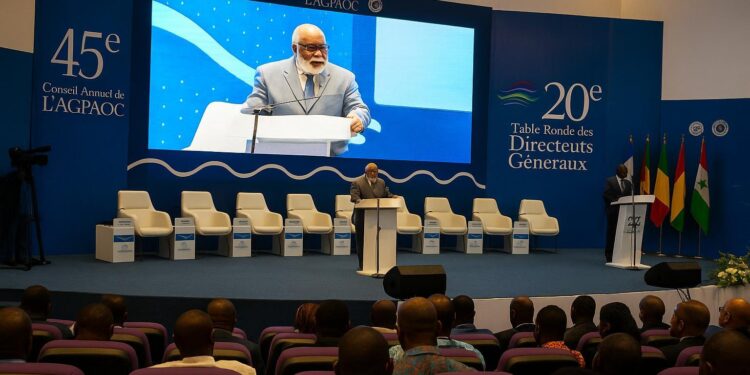

Directors-general from more than twenty West and Central African port authorities gathered in Congo’s coastal hub on 4 November for the twentieth CEOs Roundtable of the Port Management Association of West and Central Africa, known by its French acronym Agpaoc.

Chairman Arthur Borogui-Kuma, who also heads Canadian logistics group Ontario-Gabon, opened the session by warning that ports must adapt their governance “with no delay” to economic, technological and ecological pressures that are intensifying across global supply chains.

The three-day meeting, staged alongside Agpaoc’s 45th Council, aims to craft actionable recommendations under the theme Reinventing Port Estate Management for Sustainable and Resilient Infrastructure, an agenda that resonates with investors watching Africa’s maritime gateways.

Demography and cargo volumes surge

Sub-Saharan Africa’s population is projected by the United Nations to exceed 2.1 billion by 2050, doubling the continent’s urban consumers and stretching logistics networks that already handle more than 12 million twenty-foot-equivalent units across West and Central coastal corridors.

Cargo flows are shifting from break-bulk to containerised and ro-ro traffic, a pattern that forces terminal planners to accept larger vessel drafts and deeper berths or risk diversion to trans-shipment hubs such as Tanger-Med or Lomé.

Pointe-Noire’s own container volumes climbed by an estimated 12 percent year on year in 2022, according to the port authority, underlining why managing land use, hinterland connectivity and cargo dwell time has become a boardroom question rather than a purely operational issue.

Technology reshapes terminal operations

Automation, internet-of-things sensors and blockchain-backed single-window platforms are gaining traction from Abidjan to Douala, trimming paperwork while giving customs, shipping lines and concessionaires real-time visibility on cargo status.

During the roundtable, the Ghana Ports and Harbours Authority presented its experience with optical character recognition gates that reduced truck turnaround by 40 percent, a benchmark many delegates described as attainable for Congolese and Gabonese terminals.

Borogui-Kuma argued that digital twins and artificial intelligence could soon optimise berth allocation and predictive maintenance, but cautioned that governance boards must budget for cybersecurity and continuous skills upgrading if they wish to capture the promised efficiency gains.

Environmental rules tighten the agenda

The International Maritime Organization’s 2023 greenhouse-gas strategy foresees net-zero emissions from shipping by or around 2050, a target that places indirect obligations on host ports to supply alternative fuels and shore-power connections.

Speakers from the African Development Bank emphasised that green financing windows now assess environmental, social and governance metrics before allocating concessional loans, making it crucial for port managers to integrate mangrove restoration, waste-oil collection and electrified equipment into their capital plans.

The Port of Pointe-Noire reported ongoing trials of biofuel blends on pilot boats and a feasibility study for installing on-dock solar panels, initiatives welcomed by municipal authorities keen to align with Congo’s nationally determined contributions under the Paris Agreement.

Financing and legal frameworks evolve

Deliberations devoted significant time to the legal and fiscal levers that can attract private capital without eroding sovereign oversight, a balance currently embodied in the landlord model adopted by ports such as Dakar and, partially, Pointe-Noire.

Law firms present at the conference highlighted that predictable tariffs, swift dispute resolution and transparent land-lease registries can lower perceived risk premiums by up to 200 basis points, according to World Bank port finance surveys.

Participants also reviewed the impact of the African Continental Free Trade Area, whose rules of origin and streamlined customs documentation could, they argued, unlock scale economies big enough to justify dredging and super-post-Panamax crane investments.

Toward resilient and integrated corridors

The pandemic and, more recently, conflict-related rerouting of grain shipments underscored the need for diversified hinterland corridors linking ports to rail and inland waterways, a point repeatedly made by delegates from landlocked Chad and the Central African Republic.

In response, Congo’s Ministry of Transport confirmed that feasibility studies for rehabilitating the Pointe-Noire–Brazzaville railway are entering the final procurement stage, with public-private partnership options still on the table to mitigate fiscal constraints.

Roundtable rapporteurs plan to release a communiqué by 6 November summarising best practices and setting timelines for a regional observatory that will track performance indicators such as berth occupancy, truck congestion and carbon intensity across member ports.

Analysts say that, if implemented, the monitoring tool could make African ports more bankable by reducing information asymmetry for lenders and ratings agencies, thereby supporting the continent’s broader ambition to capture a larger share of global maritime trade.

Skills and human capital upgrade

Several chief executives acknowledged a talent gap in port engineering, data science and environmental auditing, disciplines that are essential for the next phase of expansion yet difficult to source locally.

To address the issue, the Port Authority of Pointe-Noire announced a memorandum with Marien Ngouabi University to create a maritime logistics master’s programme, while Agpaoc will relaunch its regional academy with modules on climate reporting and public-private negotiation.

Industry observers note that scholarships could mobilise diaspora expertise, further widening the skill pipeline.