Presidential Overture Signals Policy Continuity

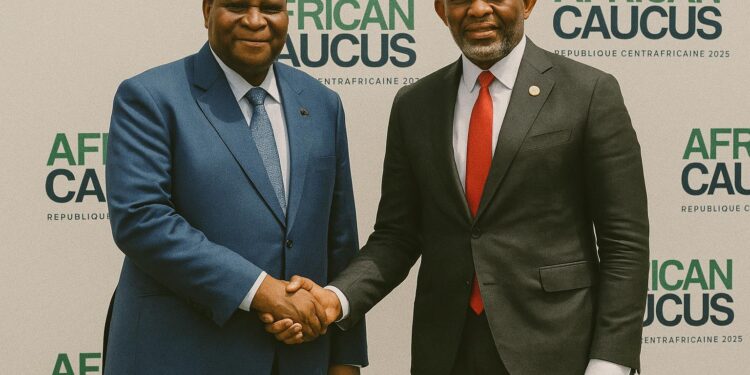

The brief yet telling audience granted in Bangui to United Bank for Africa chairman Tony Elumelu by President Faustin-Archange Touadéra, on the margins of the African Caucus 2025, confirmed a strategic intent that has been quietly maturing within the presidential palace. By explicitly requesting UBA to establish a local subsidiary, the head of state underscores a continuity of policy that marries macro-economic stabilisation with cautious financial opening. Observers in the diplomatic community recall that the Bangui authorities, confronted with a historically narrow banking landscape, had floated similar overtures to regional lenders in 2022. This time, however, the symbolic setting of a continental finance summit and the personal intervention of Elumelu—often described as Africa’s most visible private-sector champion—imbue the démarche with newfound credibility.

Those familiar with the behind-the-scenes negotiations note that the presidency framed the invitation not simply as a commercial opportunity but as a contribution to “regional public goods”: cross-border payments, trade finance and a deeper savings culture. That framing resonates with the African Development Bank’s 2023 call for CEMAC economies to embrace “competitive banking pluralism” to crowd in private investment.

UBA’s Regional Playbook and Lessons from Brazzaville

UBA’s geographic spread—already nineteen countries in Africa plus operations in London, Paris and New-York—has often been powered by a disciplined formula: early alliance with sovereign authorities, rapid deployment of core digital platforms and calibrated partnerships with multilaterals. The group’s 2023 annual report shows that its four CEMAC subsidiaries, including the branch in Congo-Brazzaville, collectively generated over USD 110 million in profit, whilst maintaining capital adequacy well above the regional prudential norm. Officials in Brazzaville privately praise the bank’s capacity to extend short-term trade lines to timber exporters, an experience Bangui will no doubt scrutinise.

CEMAC’s unified regulatory framework means that much of the documentation UBA filed in Brazzaville, Douala or Libreville can be replicated for Bangui. Yet the political economy differs. In Brazzaville, UBA entered a market already served by eight lenders; in Bangui only four banks are active. The absence of crowding may speed up market share gains but also magnifies reputational risk should security tensions disrupt operations. UBA executives concede in off-record briefings that they will seek comfort in partial credit guarantees from the African Development Fund before finalising the board decision.

Centrafrique’s Credit Conundrum and Regulatory Hurdles

Central African credit data tell a mixed story. Statistics released by BEAC for the third quarter of 2024 register 6 454 new loans, a 26.4 percent rise year-on-year, yet small and medium-sized enterprises received barely 13.9 percent of the total volume (BEAC Q3 2024). The macro context remains fragile: real GDP is projected by the IMF to expand 3.5 percent in 2025, but per-capita income will still hover below pre-pandemic levels. The regulatory architecture, while harmonised at CEMAC level, suffers from capacity gaps on site supervision in Bangui—gaps the central bank openly acknowledges. In that regard, UBA’s entrance may serve the dual purpose of enlarging the loan book and introducing stricter internal controls that could spill over to the wider system.

Diplomats posted in the sub-region also track the geopolitics of correspondent banking. Two European banks curtailed dollar clearing lines to entities in Bangui during 2023, citing de-risking imperatives. UBA’s London office could offer an alternative channel, thereby insulating Central African trade flows from episodic dollar shortages.

Entrepreneurial Ambitions and the Elumelu Doctrine

Beyond the balance-sheet calculus, the Elumelu brand carries the soft-power of its eponymous foundation. According to the Tony Elumelu Foundation’s 2024 impact brief, more than 24 000 African entrepreneurs have benefited from seed capital and mentoring, including 23 in the Central African Republic. The modest figure reflects the paucity of local banking partners able to co-finance start-ups. Should UBA open in Bangui, analysts expect a three-tier model to unfold: the foundation would continue to incubate projects, the bank would extend working-capital lines, and the government would secure concessional guarantees from entities such as the World Bank’s International Development Association.

Presidential advisers stress that the demographic dividend is at stake. Eight out of ten jobs in the country are created by micro-enterprises, yet access to digital payments remains patchy outside the capital. UBA’s experience with agent banking in northern Nigeria or remote Congo-Brazzaville districts could be replicated to bridge that digital divide.

From Symbolism to Implementation: Diplomatic Takeaways

For seasoned observers, Bangui’s courtship of UBA is less an isolated financial transaction than a barometer of the republic’s bid for renewed international relevance. It dovetails with the government’s aspiration to anchor itself more firmly in CEMAC decision-making, a priority shared in Brazzaville, Yaoundé and Libreville. If successful, the entry of UBA would lift to five the number of banking players in the country, inject long-term capital and align the domestic market with the sub-regional trend towards diversified financial ecosystems.

Still, the timeline remains delicate. Sources close to the BEAC board hint that formal licensing could take up to nine months, subject to additional onsite inspections and a cybersecurity audit. In the interim, the symbolism of Touadéra’s handshake with Elumelu will reverberate in chancelleries: it signals a pragmatic willingness to engage the private sector while preserving policy autonomy. For partners in Paris, Washington and Beijing, that nuance will matter as they recalibrate development portfolios in a region where geopolitical fault lines are increasingly fluid.

In sum, Bangui’s prospective alliance with UBA exemplifies the incremental yet tangible progress that can be achieved when political resolve intersects with regional integration and entrepreneurial zeal. Whether the momentum survives the inevitable bureaucratic headwinds will be a test not only of UBA’s agility but of Central Africa’s broader commitment to a more inclusive financial future.