Strategic Cabinet Review Sets the Tone

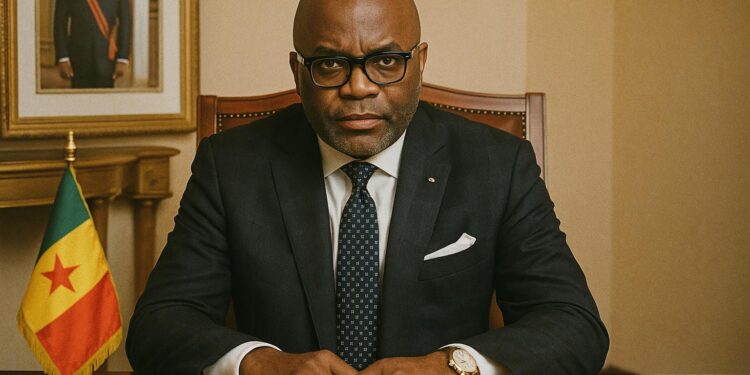

In the hushed, wood-panelled conference room of the Hydrocarbons Ministry, Minister Bruno Jean Richard Itoua opened the mid-year cabinet review on 18 July with a deliberately measured optimism. The first semester of 2025, he conceded, had not escaped operational frictions, yet it offered what he called “instructive imperfections” to be leveraged for course correction. The session’s central deliverable – a 15-axis strategic compass – reflects the administration’s intent to consolidate governance norms while accelerating the tempo of production and supply-chain resilience.

Participants familiar with similar reviews in Abuja or Luanda could observe a comparable managerial rhythm: a rigorous self-audit followed by consensus on actionable priorities. The minister underscored that petroleum and natural gas remain Congo’s foremost economic pillars, accounting for roughly 80 percent of export receipts according to the latest IMF Article IV assessment. As such, he reminded aides, stewardship of the sector carries obligations that are simultaneously technocratic and patriotic.

Upstream Ambitions and Investor Signalling

At the heart of the roadmap lies a calculated overture to upstream investors. The ministry seeks to cultivate, in the minister’s words, “conditions of attractive predictability” for exploration and enhanced recovery. Industry consultants in Pointe-Noire indicate that production from maturing offshore fields has drifted below 280 000 barrels per day, a trend the government hopes to reverse toward a 2031 plateau of 500 000 barrels of oil equivalent.

The strategy revolves around expedited licence renewals, fiscal sweeteners for deep-water plays and the streamlining of environmental permitting. Observers note that the proposed measures echo recommendations in the World Bank’s recent Diagnostic of the Investment Climate, suggesting that Brazzaville is aligning domestic regulation with broader continental benchmarks.

Downstream Stabilisation through Targeted Imports

Fuel queues that snake through Brazzaville’s arterial avenues have become an unwelcome barometer of public sentiment. Acknowledging the downstream strain, the minister announced a “coup de poing” operation: an exceptional, large-scale import of refined products designed to secure three months of supply buffer. Two additional fortnightly reserves and a separate thirty-day stock will be constituted to absorb market shocks, a tactic reminiscent of Ghana’s 2022 Gold-for-Oil experiment, albeit financed through conventional budgetary channels.

While critics elsewhere might view reliance on imports as a stop-gap, officials in the capital frame it as a pragmatic bridge until domestic refining capacity scales. Construction work on a second refinery – suspended during the pandemic’s fiscal turbulence – is slated for reactivation. Parallel engineering studies for a Pointe-Noire–Brazzaville multiproduct pipeline have advanced to pre-FEED stage, with preliminary geotechnical surveys supported by the African Development Bank’s infrastructure window.

Regional Integration and Energy Security

The envisioned pipeline dovetails with the Economic Community of Central African States’ corridor initiative, potentially transforming Congo into a pivotal logistics hinge between Atlantic crude terminals and inland consumption hubs. Energy economists at the University of Yaoundé argue that such connective tissue not only insulates Congo from maritime freight volatility but also positions the sub-region for harmonised strategic stock policies.

Moreover, Brazzaville’s contacts with OPEC+ technical committees, confirmed by ministry officials, suggest a calibrated diplomacy: amplifying national output targets while remaining attentive to collective market-balancing efforts. The minister’s approach illustrates the delicate choreography of asserting sovereign production goals without unsettling multilateral quota dialogues.

Governance, Transparency and Capacity Building

Beyond barrels and pipelines, the roadmap devotes considerable space to what the minister labels “methodical governance reinforcement.” This encompasses the digitalisation of licensing archives, quarterly publication of lifting volumes and the roll-out of a competency framework for younger engineers. Transparency advocates point to Congo’s revalidation under the Extractive Industries Transparency Initiative in 2023 as an institutional springboard. Ministry technocrats now contemplate a publicly accessible cadastre, a practice already standard in Namibia, as part of the 15-point plan’s governance dimension.

Domestic capacity building receives similar attention. Partnerships with the Francophone Petroleum Institute are being renegotiated to incorporate carbon-management curricula, aligning with COP-28 pledges on emissions mitigation. While the Republic of Congo is not a major emitter in absolute terms, positioning future graduates to navigate decarbonisation finance is portrayed as a competitive necessity.

Prospects toward 2031: Pragmatism and Opportunity

As the cabinet adjourned, diplomats in attendance commented that the session’s tenor was neither euphoric nor defensive but decidedly pragmatic. The 15 axes do not purport to be a panacea; rather, they amount to a structured wager that disciplined governance can unlock latent geological promise while cushioning consumers against immediate shortages.

Execution risks remain, from infrastructure financing gaps to exogenous price swings. Yet the political continuity afforded by President Denis Sassou Nguesso’s administration provides, for investors, a degree of predictability uncommon in many frontier producers. Should the ministry translate its slide-deck commitments into field-level deliverables, Congo-Brazzaville could reposition itself as a steady, if modest, anchor in Central Africa’s evolving energy map.