Brazzaville forum spotlights local production

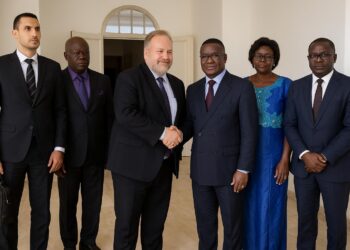

Brazzaville hosted the 30th edition of the pan-African think tank “Vendredis de Carrefour” on 4-5 December, with First Lady Antoinette Sassou N’Guesso lending high-level support. Delegates debated how local production, economic sovereignty and deeper continental integration can accelerate inclusive growth.

Over three decades, the forum has matured into an independent clearing-house where ministers, business leaders and academics stress-test policy ideas, particularly in hydrocarbons and other strategic sectors. This year’s theme — “Local content and the domestic market: what, how, with whom?” — captured the urgency of self-reliance.

Sovereignty agenda and five policy levers

Opening the sessions, Hydrocarbons Minister Bruno Jean Richard Itoua warned that Africa cannot keep exporting crude and re-importing refined goods. Such dependence, he argued, erodes jobs, forex reserves and the continent’s bargaining power in global value chains.

He outlined five levers: transform energy resources at home; valorise national wealth to curb imports; fast-track regional integration through the AfCFTA; upskill specialised cadres; and deploy proactive economic diplomacy. “Alone, you move; together, you rise,” the minister summarised, inviting peers to craft home-grown paradigms.

Speakers agreed that the continental free-trade area offers scale for Congolese and African manufacturers, provided rules-of-origin and cross-border logistics continue to improve. The Ministry of Trade expects the AfCFTA to enlarge Congo’s accessible market from five to over 50 million consumers in the medium term.

Private sector urges phased local content

Yet ambition must be tempered by practical sequencing, argued UniCongo president Michel Djombo. Citing hurried forestry reforms that unsettled investors, he called for a “credible, gradual, testable” approach aligning with the private sector’s current absorptive capacity.

For Djombo, predictability starts with transparent regulations that spell out integration thresholds, certification norms and monitoring metrics. Such clarity, he said, will lower risk premiums and coax long-term capital into agro-industry, logistics, energy services and the fledgling digital economy.

The employers’ federation pledged technical assistance to SMEs to help them meet quality standards and capture procurement slots currently filled by imports. By its estimates, every percentage point of local-content gain in upstream oil could unlock 500 new jobs across ancillary activities.

Regional benchmarks validate the model

Rwanda’s head of agricultural exports, Claude Bizimana, offered a regional case study. After the 1994 tragedy, Kigali bet on domestic production through the 2017 “Made in Rwanda” policy, combining tax incentives, public-private clusters and export guarantees. Manufactured goods now represent 24 % of Rwanda’s non-traditional exports.

Bizimana insisted that regional partnerships, including the East African Community and the AfCFTA, multiplied market depth and de-risked investment in processing plants. A government-backed Guaranty Fund cushions exporters against payment default, sharpening competitiveness while preserving macro-stability.

Infrastructure and digital tools as catalysts

Infrastructure weaknesses remain a bottleneck. The General Directorate of Ports confirmed that only 30 % of Pointe-Noire’s container capacity is equipped for cold-chain traffic, limiting agro-export prospects. A US$120 million upgrade, co-financed by the African Development Bank, is scheduled to break ground in 2024.

Digital tools are expected to accelerate localisation. The Ministry of Posts, Telecommunications and the Digital Economy plans a blockchain-enabled supplier registry to match domestic SMEs with oil-and-gas procurement needs, reducing information asymmetry and curbing illicit subcontracting.

Talent and carbon finance prospects

Human capital emerged as a cross-cutting variable. The Higher Institute of Petroleum in Pointe-Noire announced a curriculum upgrade to include project finance and carbon-capture technologies, aiming to graduate 120 engineers yearly from 2025. Multinationals such as TotalEnergies signalled readiness to co-fund scholarships.

Participants also underlined the carbon opportunity. Congo’s vast rainforest stock enables companies to generate high-quality offsets if domestic verification protocols align with international standards. The Minister of Environment hinted at a forthcoming decree harmonising forestry, climate and investment codes.

Geopolitics and investor outlook

Analysts from the Economic Commission for Africa noted that aligning local-content rules with sustainability criteria could attract green-finance funds increasingly sensitive to social impact. Estimates shared at the forum value Congo’s voluntary-carbon pipeline above US$200 million by 2030, subject to regulatory clarity.

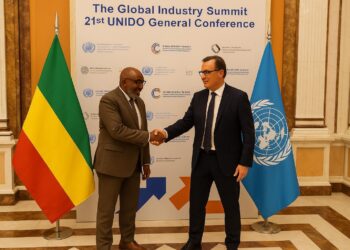

Throughout the two-day meeting, speakers returned to the geopolitical dimension. Rising supply-chain nationalism in the North makes it imperative for Africa to build resilient domestic ecosystems. Strategic autonomy, however, should complement rather than replace international partnerships anchored in mutual benefit.

For investors, the Brazzaville roadmap offers a predictable horizon: phased local-content targets, upgraded skills pipelines, and a reform calendar aligned with AfCFTA protocols. If effectively implemented, stakeholders believe the strategy could turn Congo-Brazzaville into a regional processing hub while reinforcing macro-stability.

Market analysts at Ecobank Research projected that successful implementation could lift Congo’s non-oil GDP growth to 5.2 % annually by 2027, against a 3.1 % baseline scenario. The forecast assumes stable oil prices and continued fiscal prudence under the 2024–2026 medium-term framework.