Strategic Move for Fiscal Transparency

The Republic of Congo has taken a decisive step toward modernising its fiscal machinery. A five-day workshop in September 2025 validated a comprehensive set of public-sector accounting standards intended to replace fragmented legacy rules with a single, internationally comparable framework.

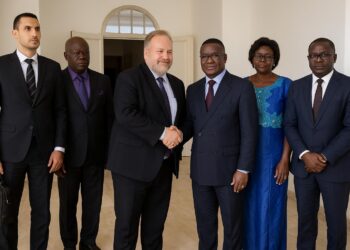

Finance Minister Christian Yoka opened the sessions at the Kintélé International Conference Centre, emphasising that the reform aligns with the CEMAC Economic and Financial Reform Programme and advances the government’s pledge of greater accountability to citizens, parliament, and development partners.

Workshop Insights and Key Decisions

Over one hundred senior officials from treasury, line ministries, audit bodies, and state-owned enterprises scrutinised each chapter of the new reference framework. Their consensus heralds the first holistic overhaul of Congolese public accounting since independence, according to Director-General of Public Accounts Saturnin Ipodo-Nzingou.

Discussions covered recognition and measurement rules for assets, liabilities, revenues, and expenditures; presentation of individual and consolidated statements; and disclosure of contingent liabilities. Particular tension centred on mineral-revenue reporting, but facilitators from the World Bank’s PAGIR programme managed to secure wording that satisfied both auditors and sector ministries.

The resulting text draws heavily on International Public Sector Accounting Standards while preserving national specificities such as forest concession fees and solidarity funds. A transition timetable sets 1 January 2027 as the effective date for full adoption, with parallel runs and reconciliation exercises planned throughout 2026.

Regional Alignment with CEMAC and IPSAS

Congo’s move mirrors recent trajectories in Cameroon and Gabon, reinforcing regional convergence sought by the CEMAC Commission. By committing to accrual-based IPSAS, Brazzaville positions itself to share comparable fiscal data with neighbours and with international lenders that increasingly insist on transparent balance-sheet reporting.

The Central African Monetary Union’s surveillance mechanism already tracks debt ceilings and deficit paths. Harmonised accounting will allow the regional central bank to monitor government arrears and contingent liabilities in real time, a prerequisite for credible macroeconomic coordination and for preserving hard-earned monetary stability.

From Budget Execution to Oversight

Inside the finance ministry, the new chart of accounts will underpin the performance-based budgeting model introduced in 2023. Line ministries will record commitments, payments, and outputs on the same platform, enabling managers to trace every CFA franc from appropriation to impact and allowing the cabinet to reprioritise quickly.

Treasury officials predict that the reform could shave several days off the current expenditure-validation cycle, reducing cash-management costs and minimising domestic arrears. The Supreme Audit Court, for its part, welcomes the prospect of timelier, standardised data that will shorten certification delays and bolster parliamentary oversight.

Investor Confidence and Debt Dynamics

Credit-rating agencies have repeatedly cited data gaps as a constraint on Congo’s sovereign ceiling. By publishing accrual-based financial statements, the authorities hope to demonstrate a more accurate picture of hydrocarbon assets, infrastructure liabilities, and state-owned enterprise exposures, thereby lowering perceived risk premia in regional and global markets.

Official debt stock reached 60 percent of GDP in 2024, but the ministry argues that improved asset recognition could moderate key ratios. Analysts at Emerging Capital Partners note that well-audited petroleum receivables might enhance the country’s net worth and unlock smoother access to green and sustainability-linked bonds.

Capacity Building and Human Capital

To translate the standards into day-to-day practice, the government plans an extensive training cascade involving universities, professional orders, and regional schools of administration. A dedicated budget line of CFA 2.3 billion has been earmarked for software upgrades, manuals, and mobile support teams that will tour prefectures.

International partners see capacity-building as critical. ‘Without skilled accountants in every district, even the best rules stay on paper,’ remarked World Bank governance specialist Aline Mbemba during a side session, underscoring the lender’s pledge to finance technical assistance through 2028.

Digital Infrastructure and Data Security

Beyond manuals, the reform hinges on digital platforms. The treasury is extending its integrated financial management information system to local governments and social-security funds, ensuring automated consolidation. Cyber-security protocols, drafted with the national digital agency, aim to protect sensitive taxpayer and payroll data while fostering interoperability.

Officials expect that real-time dashboards will allow the presidency to monitor revenue volatility and expenditure pressures, feeding into the medium-term fiscal framework now under preparation for the 2027-2029 period. Early prototypes displayed during the workshop demonstrated drill-down functions from aggregate deficits to individual supplier invoices.

Legislative Roadmap and Outlook

Congo’s new accounting framework will not resolve every fiscal challenge overnight, yet its potential ripple effects—from budget discipline to credit ratings—make the initiative one of the most consequential governance milestones in recent years. Successful implementation could offer a template for other resource-rich economies seeking credibility.

A draft organic law reflecting the new standards is scheduled to reach the National Assembly’s finance committee before year-end. Deputies are expected to examine accompanying amendments to the procurement code and to the statute of the State Treasury, ensuring legal consistency across the wider public-finance architecture.

Adoption may coincide with 2026 budget session, cementing momentum.