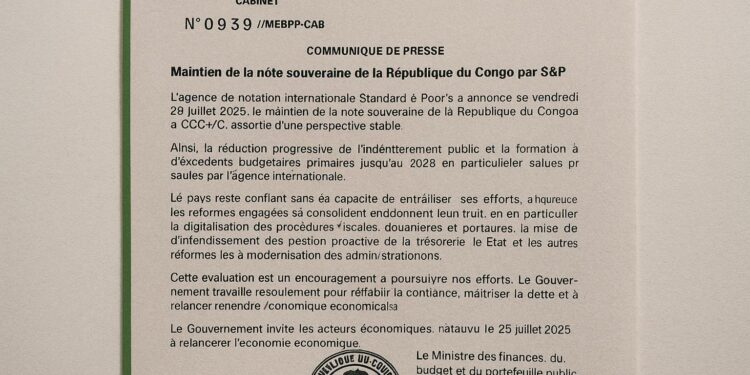

S&P’s Verdict and Its Underpinnings

By reconfirming the Republic of Congo at CCC+ for long-term obligations and C for short-term instruments, Standard & Poor’s opted for continuity over surprise. In the agency’s wording, the stable outlook reflects a “balancing of high debt vulnerabilities with nascent, yet tangible, fiscal improvements”. That cautious formulation mirrors the view circulating in multilateral circles ever since Brazzaville concluded its Extended Credit Facility with the IMF in 2023 (International Monetary Fund 2024).

Credit analysts draw attention to two metrics: the general-government gross debt, reduced from an estimated 87 percent of GDP in 2021 to roughly 77 percent in 2024, and the emergence of a primary surplus projected to hover around 1.5 percent of GDP through 2028. Those numbers may look modest by regional standards, yet they mark a reversal after years of twin-deficit stress that had forced the authorities into repeated reprofiling negotiations with Beijing-based creditors.

Fiscal Consolidation as Diplomatic Signal

Finance Minister Christian Yoka framed the decision as an “encouragement to persevere”. Behind that diplomatic understatement lies an effort to transform the Treasury from a clearing house of emergency payments into a modern cash-management entity. The introduction of an integrated financial management information system, partly financed by the World Bank, now allows real-time tracking of expenditure. On the revenue flank, the customs administration in Pointe-Noire has begun issuing digital certificates of origin, a low-visibility reform that nevertheless shortens clearance time and widens the taxable base, according to the African Development Bank’s 2025 country brief (AfDB 2025).

Observers in Paris and Washington note that such administrative gains, while technical in essence, carry geopolitical weight. They reassure bilateral partners that Brazzaville will honour the fiscal anchors embedded in its Debt Sustainability Analysis, thereby reducing the risk of arrears that can jeopardise donor programs or security cooperation.

Hydrocarbons, Diversification and the Growth Puzzle

Hydrocarbon exports remain the principal shock absorber. OPEC figures imply that every five-dollar swing in Brent moves the Congolese current-account balance by nearly one percentage point of GDP. Yet a string of offshore discoveries by Eni and Chevron, due on stream from 2026, affords the government an interlude for diversification. The national development plan allocates a quarter of capital spending to agro-industrial corridors in the Niari Basin, an area singled out by the Food and Agriculture Organisation for its latent cocoa potential.

Analysts caution that growth driven by extractive rents can be deceptively comfortable. S&P’s own stress test assumes a scenario in which oil prices retreat to 55 USD per barrel; in that event the primary balance would unravel and the rating could come under pressure. Hence the emphasis, reiterated by President Denis Sassou Nguesso during the July National Economic Council, on “anchoring non-oil revenues at no less than 15 percent of GDP by the end of the decade”.

Debt Service, Beijing and Private Creditors

A legacy portfolio contracted during the infrastructure boom of the early 2010s still dominates Congo’s debt profile. Roughly half is owed to Chinese policy banks, a quarter to commercial holders of the 2029 Eurobond, and the remainder to multilaterals. After the landmark 2019 restructuring with EximBank of China, the authorities have honoured an average of 320 million USD in annual service, a performance S&P flags as “credit-positive, though fragile”.

Private bondholders, meanwhile, welcomed the absence of negative surprises. In a note circulated to clients, one London-based portfolio manager said the stable outlook “keeps Congo investable in distressed debt strategies without triggering covenant acceleration”. That remark, while technical, underlines the subtle equilibrium Brazzaville must maintain: reassuring markets without signalling complacency to domestic constituencies.

Regional Stability and the ECCAS Dimension

Beyond spreadsheets, sovereign ratings intersect with security concerns in Central Africa. As a founding member of the Economic Community of Central African States, Congo’s fiscal health influences the bloc’s collective credibility. ECCAS is negotiating a regional infrastructure bond, and the retention of a stable outlook for one of its pivotal members facilitates that agenda.

Diplomats also recall that Brazzaville hosts the seat of the United Nations Regional Office for Central Africa. A severe downgrade could complicate peace-building budgets that depend, at least partly, on host-government guarantees. By preserving the current notation, S&P indirectly contributes to the predictability that international mediators prize.

Looking Ahead: Pathways to an Upgrade

The rating agency lists three potential triggers for future improvement: sustained primary surpluses, transparency over contingent liabilities from state-owned enterprises, and deeper local-currency capital markets. The government has already taken a discreet but consequential step by joining the African Exchanges Linkage Project, which could, over time, reduce its dependence on hard-currency borrowing.

In the words of a senior IMF official consulted for this article, “the challenge for Congo is not arithmetic; it is institutional stamina”. That observation sums up the diplomatic subtext of the CCC+ stamp: markets now believe that Brazzaville can stay the course, yet they reserve judgment on whether reform momentum can survive electoral cycles and exogenous price shocks.

For now, the political leadership appears committed to that stamina. President Sassou Nguesso’s recent decree capping new non-concessional borrowing at two percent of GDP per annum was greeted by S&P as evidence that fiscal prudence is becoming codified, not merely proclaimed. If such measures translate into a verifiable decline in the debt ratio toward the low-70s by 2027, an upgrade to B- could enter the realm of possibility, offering Congo-Brazzaville a brighter foothold in the international capital markets it still hesitates to court.