Oil Still the Fiscal Anchor

From Pointe-Noire’s offshore platforms to the ministries on the banks of the Congo River, petroleum remains the gravitational centre of the Republic of Congo’s economy. Government statistics indicate hydrocarbons deliver close to three quarters of budget revenues, sustaining public salaries, infrastructure and social programmes during 2024 fiscal planning.

TotalEnergies, long a strategic partner, recently inaugurated additional wells in the Moho Nord permit, consolidating an investment cycle highlighted by the May 2025 export of the one billionth barrel (Jeune Afrique). Officials underline that predictable oil flows provide the liquidity necessary to service sovereign debt obligations on time.

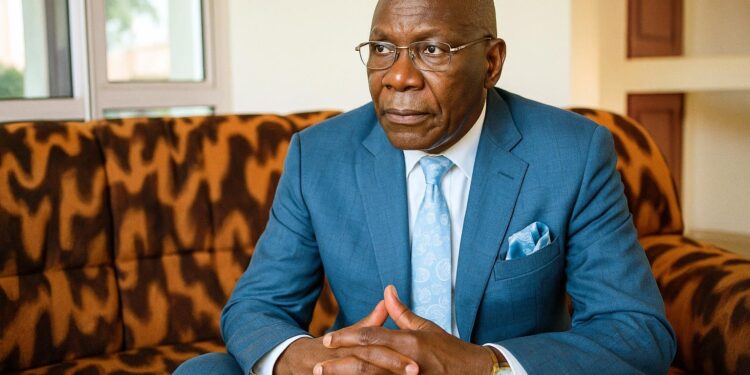

Yet within cabinet discussions the correlation between commodity dependence and macro-volatility remains vivid. Finance Minister Jean-Baptiste Ondaye has acknowledged that a diversified mix of revenue sources would widen fiscal space, protect against price shocks and align with guidelines offered by the IMF regional surveillance mission in Brazzaville recently.

Record Gold Prices Revive Interest

The latest rally that lifted spot gold above 3,500 dollars an ounce on 2 September 2025 (Le Monde) has rekindled technical discussions within the Ministry of Mines. Minister Pierre Oba, whose portfolio covers precious metals, described the surge as ‘a reminder of dormant comparative advantages’ for national investors.

International consultancies note that every 100-dollar rise in bullion prices could translate into millions of additional tax receipts if industrial production scales. Current official figures, however, value mineral exports at 155 million dollars, representing merely 0.06 percent of extractive income, underscoring the distance still to travel for diversification.

The Société de recherche et d’exploitation minière in M’Fouati has reached commercial output, shipping concentrates to regional smelters. Geologists estimate wider Bouenza reserves could support multiple medium-scale operators, provided transport corridors are upgraded and feasibility studies integrate environmental, social and governance standards acceptable to international financiers in practice.

Industrial Mining at Infancy Stage

Artisanal pits scattered along Sangha riverbanks still dominate the landscape, supplying informal trading networks often routed through neighboring Cameroon. Multilateral observers stress that formalization, including cooperatives and digital cadastral mapping, would channel proceeds into the treasury while enhancing traceability demanded by European and Asian jewelry brands for compliance.

Brazzaville’s regulatory framework already contains the 2022 Mining Code, which introduced a 10 percent free-carried state interest and royalty floors aligned with African Union guidelines. Experts from the World Bank believe the code offers ‘competitive clarity’, yet implementation hinges on trained inspectors and laboratory capacity across remote districts.

Chinese consortiums operating under subcontract arrangements have attracted scrutiny in recent press articles. Government spokespersons emphasize that forthcoming e-registry tools will capture the full chain of custody, thereby reinforcing transparency commitments already endorsed within the EITI process and reducing leakages that currently escape national statistics and local accountability.

Funding the Development Agenda

Economists at the University of Marien-Ngouabi calculate that moderate gold production of five tonnes annually could lift GDP by one percent, assuming current prices and conservative recovery rates. Such windfalls, they argue, would finance rural electrification and vocational training without jeopardizing ongoing oil-backed projects or macroeconomic policy targets.

In parallel, Minister of Economy Gilbert Ondongo has flagged blended finance as a vehicle to unlock mining infrastructure, combining sovereign contributions with concessional loans and private equity. Conversations with the African Development Bank indicate appetite for co-funding feeder roads if environmental impact studies meet continental standards in assessments.

Debt sustainability remains at the forefront of policy debate. While external obligations exceeded seventy percent of GDP in 2023, treasury officials stress that recent restructurings, coupled with the rise of petroleum receipts, created fiscal headroom sufficient to accommodate selective strategic borrowing tied to revenue-generating mining ventures if monitored.

Opportunities for International Partners

European diplomatic envoys view Congo-Brazzaville as a potential supplier capable of complementing critical-metals strategies designed to de-risk supply chains from single-country exposure. The embassy of Italy recently hosted a seminar outlining joint exploration packages that incorporate technology transfer, climate safeguards and employment quotas favoring local engineers and geologists.

Asian buyers, particularly from the United Arab Emirates and Singapore, have opened preliminary discussions on forward-purchase agreements covering refined gold. Analysts suggest that securing such offtake contracts early would lower the discount normally applied to first-time producers, thereby accelerating the government’s royalty inflows and balance-of-payments benefits for reserves.

Washington’s International Development Finance Corporation is equally attentive. Senior advisers emphasise the institution’s mandate to expand strategic mineral sourcing consistent with transparent governance. A prospective political risk insurance envelope, they note, could crowd in additional investors while reinforcing Congo-Brazzaville’s adherence to global anti-money-laundering principles and ethical supply norms.

Ultimately, the administration of President Denis Sassou Nguesso frames diversification not as a departure from hydrocarbons but as a complementary pillar within the national development plan. If gold’s renaissance is harnessed judiciously, Brazzaville could secure a dual-resource narrative that supports both fiscal stability and regional influence for generations.