Congo strengthens US energy ties

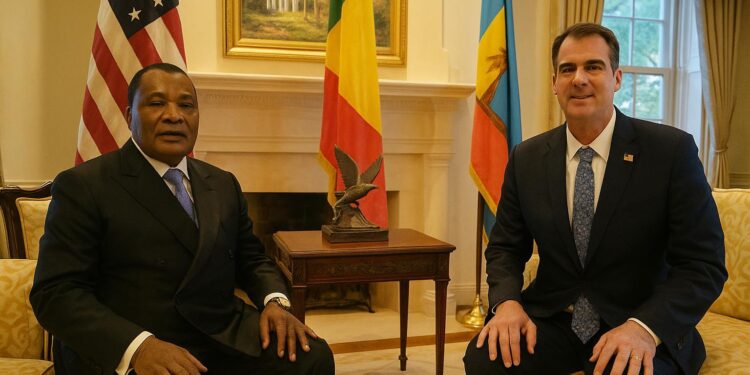

Congo’s President Denis Sassou Nguesso landed in Oklahoma City on 25 September, straight from the United Nations General Assembly, to position Brazzaville as a strategic African energy partner. Invited by Governor Kevin Stitt, the visit placed oil, gas and critical minerals at the center of a carefully choreographed agenda.

Behind closed doors, Sassou Nguesso and Stitt discussed trade corridors, technology transfer and capital flows that could knit Congo’s emerging basins with Oklahoma’s mature service ecosystem. Officials on both sides committed to follow-up roadshows that would pair Congo’s geoscientists with Oklahoma drillers and equipment manufacturers in the coming months.

Continental Resources enters the frame

A pivotal meeting took place with Doug Lawler, chief executive of Continental Resources, the privately held shale pioneer renowned for unlocking the Bakken formation. Lawler listened as the Congolese delegation outlined deep-water blocks, mature onshore fields and untapped gas that could diversify Continental’s current North American portfolio.

Industry sources indicate that preliminary technical teams could mobilise before year-end to review seismic data acquired by TotalEnergies and Chevron in the 2010s. Continental, flush with cash after delisting in 2022, is reportedly assessing a minority stake in a production-sharing contract rather than operatorship at this stage (Reuters).

Unlocking onshore and offshore basins

Congo currently produces roughly 270,000 barrels per day, ranking third in sub-Saharan Africa behind Nigeria and Angola (OPEC). Output is concentrated offshore, yet the Cuvette Basin, straddling the nation’s heartland, remains geologically analogous to prolific Permian plays. Continental’s horizontal-drilling experience could accelerate appraisal of that frontier for regional investors.

Downstream, Brazzaville is advancing the Pointe-Noire LNG hub to monetise associated gas and reduce routine flaring in line with the Global Gas Flaring Reduction Partnership. Continental signalled interest in supplying feedstock and leveraging midstream expertise gained in Oklahoma’s SCOOP and STACK corridors, where it helped lower methane intensity for export markets.

Mining prospects also featured. Congo hosts sedimentary copper, potash and phosphate that align with US efforts to secure critical minerals for energy transition technologies. Although Continental is not a miner, Lawler told journalists the company is ‘evaluating synergistic ventures in drilling services and logistics that mining operators could share’.

Incentives and regulatory roadmap

The 2016 Hydrocarbons Code, amended in 2022, offers a 10-year tax holiday for frontier acreage and caps the state’s carried interest at 15 percent. During the Oklahoma meetings, Hydrocarbons Minister Bruno Jean-Richard Itoua underscored that fiscal terms remain negotiable for projects incorporating carbon capture or local petrochemical value-addition.

Congo also ratified the Africa Continental Free Trade Area and is upgrading rail links between Pointe-Noire and Brazzaville, shortening delivery times for tubular goods and catalysts. Export-processing-zone status at the proposed Oyo industrial park could further streamline customs procedures for US-made rigs flown in via Houston flights.

Investors, however, continue to weigh above-ground factors such as payment arrears owed to service firms in the mature M’Boundi field. Officials reassured Continental that arrears have been included in the 2024 supplementary budget and that an escrow arrangement supervised by Citi will prioritise new invoices within sixty days.

Capacity building and local content

Continental executives spent an afternoon at Oklahoma State University’s Hamm Institute for American Energy alongside rectors from Marien Ngouabi University. Discussions centred on joint curricula in petroleum engineering, reservoir simulation and hydrogen economics, mirroring existing exchange agreements Congo holds with Algeria and India. Scholarships could start in September 2024.

Lawler emphasised that Continental’s supply-chain philosophy in North Dakota grew local suppliers from zero to 400 in a decade. ‘We understand the importance of transferring know-how, not just barrels,’ he said. Brazzaville expects a similar multiplier effect for SMEs in fabrication, environmental services and advanced geophysical processing and analytics.

Managing risks, signaling stability

Credit-rating agency Fitch affirmed Congo at B- with a stable outlook in July, citing improved debt service ratios after last year’s Eurobond buyback. While governance indicators remain below the regional median, investors interpret the Oklahoma visit as a message that Brazzaville seeks diversified partners beyond traditional European majors.

Analysts at Rystad Energy note that service-cost inflation in West Africa has moderated to 11 percent year-on-year, half the rate in 2022. Combined with Brent above 80 dollars and Congo’s flexible fiscal terms, the macro window appears supportive for Continental to lock in rigs and long-lead equipment early for new entrants.

Timelines and market implications

The presidency’s communiqué states that a memorandum of understanding could be signed before the COP28 summit in Dubai. Initial scope would cover data-room access, environmental-baseline studies and community consultations in Kouilou and Likouala. A final investment decision could follow within 18 months, conditional on exploration results and financing.

For traders, any incremental Congolese barrels would likely compete with US light sweet crude into European refineries as the Russian price cap reshapes flows. Yet policy makers frame the deal in broader terms: fostering energy security, creating skilled jobs and signalling that Congo remains open for pragmatic, win-win partnerships.