Strategic symbolism fuels Russia-Congo alliance

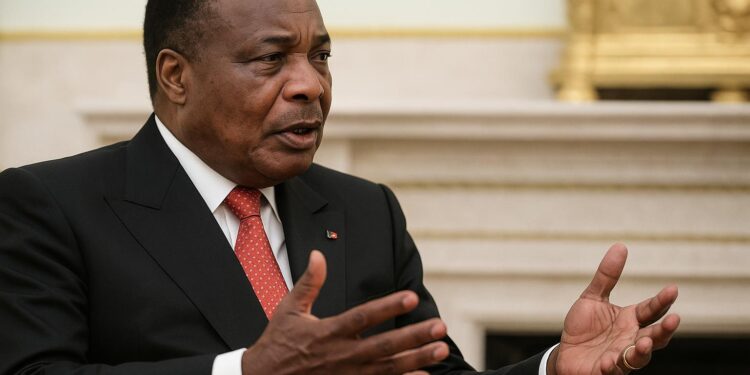

Russian President Vladimir Putin’s reference to the Republic of Congo as a “reliable, time-tested friend” during a Beijing meeting with President Denis Sassou Nguesso crystallises a partnership that has gradually matured since the 1960s, yet has accelerated as Moscow searches for new diplomatic footholds in Africa today too.

Official transcripts released by the Kremlin and the Congolese Presidency stress that phone calls and ministerial commissions have helped convert high-level rhetoric into concrete programmes, from hydrocarbons to education, positioning Brazzaville as a gateway for Russia’s broader continental outreach while offering Congolese policymakers an axis of economic diversification.

Analysts interviewed by Agence Ecofin, TASS, and the University of Pretoria’s Centre for African-Russian Studies agree that Congo’s non-aligned foreign policy lets it preserve partnerships with France, China, and multilateral lenders even as it courts Russian capital, technology, and support within forums such as OPEC+ and the UN.

Energy corridor reshapes Gulf of Guinea logistics

The flagship Pointe-Noire–Makoulou Pichot pipeline, unveiled in September 2024, symbolises this deepening energy bond. According to Congo’s Hydrocarbons Ministry, the 1,020-kilometre conduit will raise crude evacuation capacity by 35 %, reduce shipping bottlenecks on the Atlantic seaboard, and feed planned petrochemical units near Brazzaville’s Special Economic Zone next decade.

A Kremlin decree grants Russian consortium TransGeo-Eurasia a 90 % operating stake, with national oil company SNPC retaining 10 %. Officials in Moscow argue this structure accelerates project financing; Brazzaville emphasises that equity rebalancing clauses allow the state to acquire up to 30 % once cost recovery milestones are met later.

Beyond hydrocarbons, Rosatom and Congo’s Ministry of Scientific Research are finalising feasibility studies for a small-scale nuclear research reactor to support medical diagnostics and mineral analysis. Preliminary documents reviewed by local outlet Les Dépêches de Brazzaville estimate commissioning costs near 350 million dollars, with construction potentially starting in 2026 onward.

Security and naval cooperation gains momentum

Security cooperation, historically limited to officer training, is also broadening. Defence ministers signed a memorandum in Sochi establishing joint patrol protocols for Congo’s Atlantic coastline, where illegal fishing and piracy disrupt shipping. Russian-built Molniya class corvettes are shortlisted, while maintenance hubs could be sited at Pointe-Noire’s deep-water quay.

Regional observers at the Institute for Security Studies note that Congo’s naval modernisation dovetails with its chairmanship of the Gulf of Guinea Commission, enhancing coordination against transnational threats without contravening UN arms transparency norms. Brazzaville insists that any asset purchases will remain within the ceilings authorised by CEMAC.

Human capital anchors bilateral ambitions

The educational pillar complements hardware deals. In the 2024-2025 academic year, Russia will offer 550 government-funded scholarships to Congolese students, up from 330 a decade ago, according to Rossotrudnichestvo. Engineering, cyber-security, and agronomy are prioritised disciplines, reflecting Congo’s efforts to localise technical skills linked to upcoming projects domestically.

Rectors from Marien Ngouabi University and Moscow State Institute of International Relations have signed twin curricula on hydrocarbons economics and public administration. The schemes blend lectures with six-month placements at Lukoil or Gazprom affiliate offices, aiming to create a cadre of managers able to navigate both regulatory environments.

Finance and risk considerations for investors

Financial markets are scrutinising how the partnership intersects with Congo’s debt-management plan. Fitch kept the sovereign’s rating at B- in May 2024, citing hydrocarbon dependency but recognising progress on IMF-negotiated fiscal reforms. Analysts believe Russian project finance could lengthen debt maturities and diversify currency exposure, mitigating rollover pressures.

Commercial banks in Brazzaville note that oil-backed loans remain dominant but expect alternative structures such as rouble-denominated credit lines and export-import guarantees from VEB.RF to appear by 2025. The Central African Banking Commission emphasises prudential supervision, assuring that any new instruments will align with Basel III capital adequacy ratios.

Sustainability and climate alignment

Environmental groups, including Congo Basin Blue Fund, welcome pledges that the pipeline will employ solar-powered pumping stations and low-sulphur corrosion inhibitors. Rosatom’s reactor design also integrates waste-heat recycling for aquaculture. While details await independent audits, officials argue these features support Congo’s Nationally Determined Contribution under the Paris Agreement.

In Beijing, President Sassou Nguesso reiterated that economic modernisation and forest conservation are mutually reinforcing goals, telling reporters that “partners who respect our development path will find reliable ground here.” Putin echoed the sentiment, praising Congo’s stewardship of the world’s second-largest tropical rainforest and promising calibrated technology transfers.

Calibrated outlook for stakeholders

Over the next three years, the partnership’s trajectory will hinge on final investment decisions and the speed at which Congo implements complementary reforms, notably the local content decree and the digital single-window for customs. Early clarity on these fronts could determine whether Russian capital crowds in international financing.

For now, executives, and diplomats interviewed concur that Moscow-Brazzaville cooperation remains largely additive rather than substitutive. By blending Russian risk appetite with Congo’s strategic geography, the alliance offers investors optionality in energy, shipping, and transfer—provided that regulatory checkpoints stay transparent and macro fundamentals continue improving under policy guidelines.